Few studies have been conducted into how cybercriminals quickly clean stolen funds without attracting attention: this report is long overdue.

Take a look inside the complex web of money mules, front companies and cryptocurrencies that criminals use to siphon funds from the financial system after a cyber-attack. That is what a new report by secure financial messaging service SWIFT and cybersecurity consultancy BAE Systems Applied Intelligence.

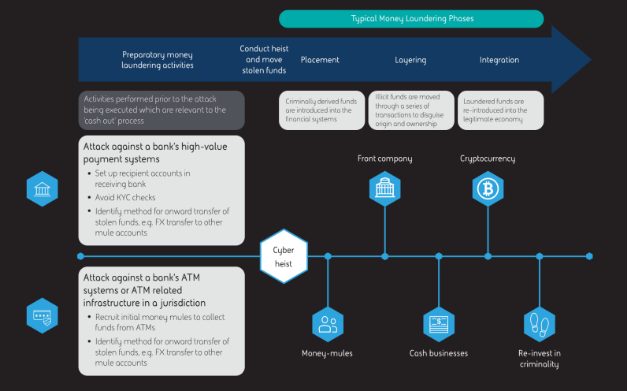

The report highlights the ingenuity of money laundering tactics to obtain liquid financial assets and avoid any subsequent tracing of the funds. For instance, cybercriminals often recruit unsuspecting job seekers to serve as money mules that extract funds by placing legitimate-sounding job advertisements, complete with references to the organization’s diversity and inclusion commitments.

They use insiders at financial institutions to evade or undermine the scrutiny of compliance teams carrying out know-your-customer (KYC) and due diligence checks on new account openings. And they convert stolen funds into assets such as property and jewelry that are likely to hold their value and are less likely to attract the attention of law enforcement.

SWIFT commissioned BAE Systems to investigate this element of the money laundering process as part of its Customer Security Programme (CSP). The CSP continually helps the financial community to strengthen its cyber defenses through a range of measures including mandatory controls, intelligence sharing and thought leadership.

Although there has been much research into the methods that cybercriminals use to conduct attacks, there have been fewer studies into what happens to funds once they have been stolen. The aim of this report is to illuminate the techniques used by cybercriminals to ‘cash out’ so that SWIFT’s global community of over 11,000 financial institutions, market infrastructures and corporates can improve protective measures.

Said Brett Lancaster, Head of the Customer Security Programme, SWIFT: “The threat posed by cyber-attacks to the financial sector has never been greater. Attackers are well-resourced, constantly evolving their modus operandi and using untraceable money laundering techniques. The report highlights how the growth in cyberattacks is increasing the need for the convergence of anti-money laundering, fraud and cybersecurity processes in financial institutions. It calls for them to increase information sharing, tighten due diligence requirements and smartly invest in maintaining systems to strengthen their defenses.”

Here are some of the findings in the report, titled ‘Follow the Money’:

- Front companies—cybercriminals tend to focus on textile, garment, fishery and seafood businesses to obfuscate funds. They find it easier to operate in parts of East Asia where less stringent regulations make it easier to conduct their activities.

- Cryptocurrencies—while the number of identified cases of money laundering through cryptocurrencies is low so far, there have been a couple of major incidents involving millions of dollars. Digital transactions are appealing because they are conducted in a peer-to-peer manner that circumvents the compliance and KYC checks conducted by banks, and often require only an e-mail address.

- Experience—The method chosen by cybercriminals to cash out and spend the stolen funds is indicative of their levels of professionalism and experience. Some inexperienced criminals have immediately made extravagant purchases drawing the attention of law enforcement agencies and leading to arrests.

BAE Systems Applied Intelligence’s Cyber Security Financial Services Sector Lead, Simon Viney commented: “The activity from cybercriminals and gangs across the world is estimated to result in over $1.5 trillion dollars in annual losses. This report focuses on money-laundering-related activities necessary for cyber attackers to conduct and ‘cash out’ a successful attack and avoid the money subsequently being traced.”

As technology and criminals’ techniques evolve at a rapid pace, so will the need for institutions, both private sector and law enforcement, to collaborate and maintain awareness of evolving money laundering techniques, he said. “This is to reduce the opportunities for threat groups to benefit from committing high-value cyber heists.”