Urgent digitalization and pivoting caused firms to lose focus on fraud vigilance, but other factors were also at play: study

What is the true cost of fraud in retail, ecommerce and financial institutions in Australia, Hong Kong, India and Japan during the ongoing pandemic, and what are the pain points for firms embracing new payment mechanisms and digital business models to stay resilient?

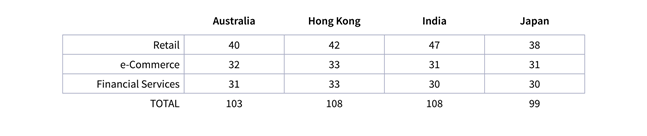

In a LexisNexis study this year to answer the above questions—involving 418 risk and fraud executives in retail, ecommerce, financial services and lending companies— the total amount of loss a firm suffered based on the actual USD value of a fraudulent transaction—showed the cost per transaction to be $3.51 in Australia; $3.61 in Hong Kong; $3.87 in Japan, and $3.84 in India.

All four countries reported higher costs per transaction than the regional 2019 average of US$3.40 that involved other APAC markets.

Some factors that drove the high cost of fraud in the study include: market events influencing the use of transaction channels/payment methods; the challenges that businesses faced when assessing fraud with these transactions; and the less-than-optimal approach that businesses have been taking towards fraud detection, prevention and minimizing customer friction. Other study findingsinclude:

- Financial institutions incurred higher fraud costs

Given the heavy account-based nature of their business and the need to repay fraud losses to customer accounts, financial institutions in the study often employed more internal and external labor for investigation, detection and recovery. On average they spent (in USD) $3.78 per transaction in Australia, $4.70 in Hong Kong, $4.46 in Japan and $4.76 in India. - Urgent digitalization reduced fraud preparedness

The pandemic presented the same challenges to all the countries in the study, through shutdowns, fear of in-person contact and fear of transmission. However, the disruption was not equal. Each market saw a marked increase in the use of digital transactions and digital payment methods while cash and in-person payments dropped. However, Hong Kong and India changed more fundamentally as these markets have traditionally had more in-person and cash-driven transactions. Businesses in both markets needed to adapt quickly and many were unprepared from a fraud detection standpoint.

- Identity verification remained a top challenge

Common online and mobile channel challenges across markets included identity verification and determining transaction origination. The rise of synthetic identities was the most common source of identity verification issues. E-commerce merchants in the study had indicated that transaction origination was more commonly cited as a challenge due to their limited use of solutions to capture device ID and geolocation. The rise of mobile and digital wallets as well as other contactless payment methods had created difficulties for many e-commerce merchants when assessing fraud risk related to these channels.

- Limited use of best-practice fraud detection/mitigation

The use of digital/passive identity authentication solutions and transaction risk assessment solutions was limited in the Australia and Hong Kong markets. The number of organizations in the study that had integrated cybersecurity and/or digital customer experience with fraud operations was also limited in both markets. The e-commerce sector for the Hong Kong market was an outlier as it was fairly nascent and still in a developmental stage. This is primarily because Hong Kong has enabled easy access to area businesses, and in-person transactions have been much more common than those made online.

According to Cameron Church, Director (Fraud and Identity), LexisNexis Risk Solutions, fraudsters are becoming more sophisticated, so businesses need a robust fraud and security technology platform offering strong fraud management while maintaining a low-friction customer experience: “A successful fraud detection and prevention approach involves an integration of technology, cybersecurity and digital experience programs to address unique risks from different transaction channels and payment methods.”

Church asserted that a multi-layered solution approach has proven to be the most effective way to fight fraud across various channels and transaction types, in addition to performing a more complete assessment that combines physical and digital identity data analysis. “Using different solutions to support fraud detection at various points throughout the customer journey will strengthen a firm’s overall defense,” he noted.